I. Executive Summary

The landscape of climate technology investment is currently navigating a significant paradox: despite an increase in capital reserves held by climate tech funds, actual investments in startups within the sector, particularly in later-stage funding rounds, have experienced a notable deceleration. This creates a critical “missing middle” challenge, where companies that have successfully developed and proven their initial technologies struggle to secure the substantial capital required for large-scale commercialization and deployment. This complex dynamic is driven by a confluence of underlying factors. The inherent capital-intensive nature and long development cycles of many climate technologies often clash with the traditional venture capital model’s pursuit of rapid returns.

Macroeconomic headwinds, characterized by high interest rates and broader economic uncertainties, have made investors more cautious. Concurrently, a pronounced shift in investor priorities towards immediate profitability and the burgeoning appeal of artificial intelligence (AI) have diverted significant capital away from climate tech. Furthermore, policy uncertainties and a perceived scarcity of lucrative exit opportunities exacerbate the challenges for growth-stage climate ventures.Addressing this paradox is paramount for accelerating the global green transition. It necessitates a strategic pivot towards innovative financing models, robust corporate and governmental support, and a renewed, unwavering focus on commercial viability and capital efficiency from climate tech innovators.

II. Understanding the Climate Tech Investment Paradox

Defining the Paradox: A Tale of Two Funding Realities

The core of the climate tech investment paradox lies in a fundamental discrepancy: while the overall capital available within climate tech funds continues to grow, the rate at which this capital is deployed into new investments has slowed considerably. This is not merely a symptom of a broader venture capital slowdown; it reveals a sector-specific “capital-deployment disconnect.” Funds may possess substantial reserves, but a reluctance or inability to invest these sums suggests a deeper issue than simple capital scarcity. It points to a fundamental misalignment between the long-term, often capital-intensive nature of climate technology investments and the traditional venture capital appetite for quicker returns and lighter, more scalable business models. This disconnect implies that merely accumulating more “climate funds” will not resolve the paradox; instead, it demands addressing the underlying structural and market conditions that deter the effective deployment of existing capital.

This challenge is particularly acute in what is termed the “missing middle” for climate tech funding. This refers to the critical funding gap encountered by growth-stage companies, typically those seeking Series B and Series C investments. These companies have often progressed beyond initial product development and market validation, demonstrating technological viability and early traction. However, they require substantial capital infusions to scale their operations, expand market reach, and transition from pilot projects to industrial-scale deployment. Without this crucial follow-on funding, promising climate solutions risk stalling before achieving their full environmental and economic potential.

Historical Context: Lessons from Cleantech 1.0 (2005-2011) and the Rise of Climate Tech 2.0 (Post-2015)

The current investment paradox in climate tech bears striking resemblances to the “Cleantech 1.0” era, which unfolded between 2005 and 2011. During this period, cleantech massively attracted venture capital, particularly in Silicon Valley, fueled by high oil and gas prices, significant public incentives (such as the American Recovery and Reinvestment Act in the US), and heightened climate awareness. Investors, having witnessed spectacular successes in software and biotech, mistakenly believed they could apply the same “Silicon Valley model” of rapid investment and quick exits to energy technologies.

However, cleantech technologies like solar, batteries, and biofuels fundamentally differed from software. They demanded significantly more capital, longer development timelines, and heavy infrastructure to reach industrial scale, involving the production of renewable energy, electric vehicles, or battery systems. The bankruptcy of Solyndra in 2011, a solar energy startup that had received over $500 million in public funds, became a symbolic failure of this model. It exposed critical structural problems: high production costs relative to Asian competition, technological risks where promising ideas failed in market tests, over-reliance on uncertain public subsidies, and a collapse in natural gas prices that undermined business models. Few cleantech companies found buyers before achieving industrial profitability, and large energy companies withdrew from the sector. The result was devastating: over 90% of cleantech startups funded after 2007 did not even recover initial capital, and only half of the $25 billion invested was returned to investors. This led to a “wilderness” period for cleantech from 2012-2015, where VC funding plummeted by more than half.

The current investment landscape, particularly the later-stage funding lag, echoes these historical challenges. The repeated issues of high capital intensity, long development cycles, technological risk, and the difficulty in securing industrial buyers, which plagued Cleantech 1.0, are explicitly mentioned as persistent challenges for Climate Tech 2.0. The recent bankruptcy of Northvolt, an electric battery developer that had raised $9 billion, serves as a painful modern-day reminder of the Solyndra episode. Northvolt’s struggles with high industrial costs, execution delays, and intense price competition highlight the persistent difficulty in rapidly and profitably industrializing complex technologies. This suggests that despite the “new approach” and the emergence of “patient capital” in Climate Tech 2.0, the fundamental economic realities of hard tech climate solutions continue to clash with traditional venture capital models, making later-stage funding inherently riskier and less attractive for many generalist investors. The historical context thus implies that the current later-stage funding lag is not merely a temporary market correction but a deep-seated structural challenge inherent to the nature of capital-intensive climate technologies. For solutions to truly scale, they must fundamentally address this mismatch, rather than simply waiting for economic conditions to improve.

The turning point for the “renaissance” of climate innovation came with the Paris Agreement in 2015. This marked the rise of “Climate Tech,” distinguished by a more focused approach on measurable climate impact, particularly the reduction of greenhouse gas emissions. A key differentiator was the emergence of “patient capital” from investors like the Breakthrough Energy Coalition, who acknowledged that climate projects require more capital, time, and risk, moving beyond the traditional 3-5 year VC cycles. The new ecosystem is characterized by specialized funds, direct corporate investments (e.g., by Amazon, Microsoft) driven by net-zero commitments, and significant public policies like the Inflation Reduction Act (IRA) in the US and the European Green Deal.

Current State of Climate Tech Investment: Overall Trends (2021-2024)

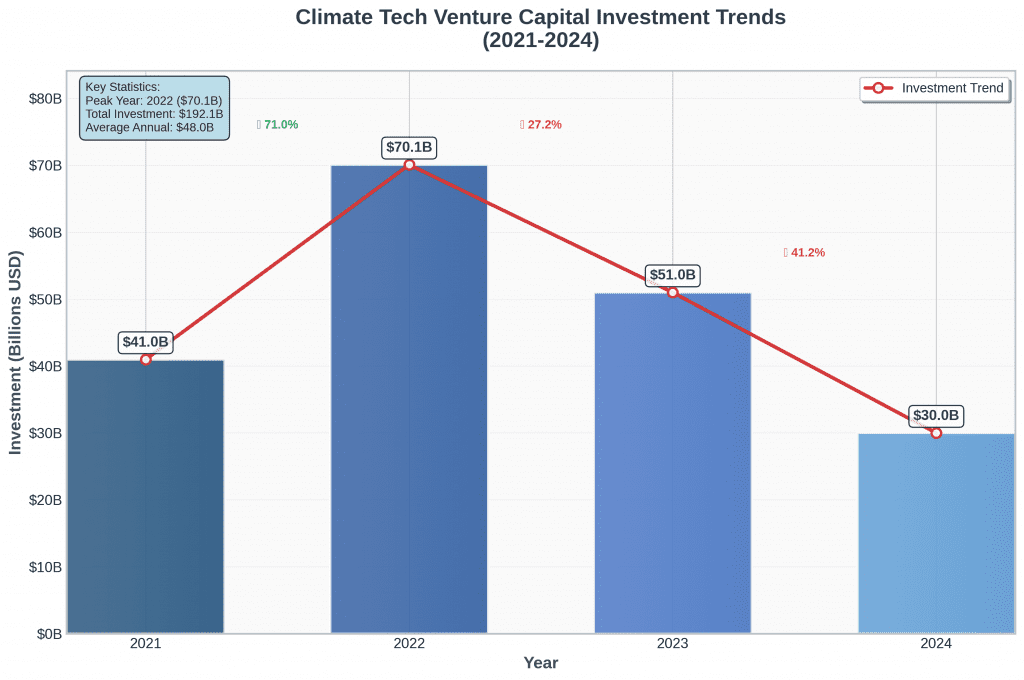

Global climate tech investment experienced a significant surge, peaking around 2021-2022, with total venture and growth investment reaching approximately $70.1 billion globally in 2022. In North America and Europe, VC funding for climate tech peaked at $41 billion in 2021. However, since then, the sector has seen a consistent decline. In 2024, venture and growth investment totaled $30 billion, a 14% decrease from 2023. PitchBook data indicates that climate tech startups in North America and Europe raised $24 billion in 2024, a 17% year-over-year fall, marking the third consecutive annual decline. Globally, other reports indicate a drop from $25.9 billion in 2022 to $17 billion in 2024, representing a 34% decrease over two years.

The growth trajectory has also significantly slowed. While cumulative investment reached $182 billion in 2024, the Compound Annual Growth Rate (CAGR) for 2020-2022 was a remarkable 135%, which sharply decelerated to 25% for 2022-2024. This suggests that the climate tech market is moving past its initial “euphoria” and speculative phase , settling into a “new normal” characterized by slower, more linear growth. This maturation implies a more cautious approach from investors and a “flight to quality,” where the strategic intent behind deals might be stronger, focusing on companies with clearer pathways to commercialization and profitability. Consequently, startups now need to demonstrate stronger fundamentals and a clearer path to profitability earlier in their lifecycle, making the fundraising landscape more competitive.

The outlook for Q1 2025 shows continued challenges, with investments in climate tech startups reaching their lowest level in five years, hovering around $2.3 billion to $2.9 billion globally. Despite this downturn, climate tech has shown relative resilience compared to the broader venture capital market. For instance, the 12% decline in climate tech funding from 2022 to 2023 was less severe than the 35% decline reported for all startups by PitchBook during the same period. This indicates an underlying strength and continued, albeit more discerning, investor interest in the sector.

III. The Resilience of Early-Stage Climate Tech Funding

Despite the overall cooling in climate tech investment, early-stage funding has demonstrated a degree of resilience, particularly in terms of capital volume. Seed investment has consistently hovered around $2.7 billion globally since 2022, indicating a stable appetite for foundational bets in climate technology. While PitchBook data shows a slowdown in seed deal count in the US, dropping from 246 deals to 152 in 2024 , and CTVC reported a 12% slip in seed funding and a 30% decrease in deal count in H1 2024 , the average deal size between Seed and Series A increased by 19% in H1 2024. This indicates a “quality over quantity” shift, where investors are becoming more selective at the earliest stages, concentrating larger amounts of capital into fewer, higher-conviction bets. This rising bar means that while it might be more challenging for all early-stage startups to secure funding, those with compelling value propositions, strong teams, and clear pathways to scalability are still attracting significant capital. Seed funding remains crucial for initial market research, product development, and establishing founding teams.

Several factors contribute to this sustained, albeit more discerning, confidence in early-stage climate tech:

- Focus on Less Capital-Intensive Models: Unlike the Cleantech 1.0 era, Climate Tech 2.0 often emphasizes less capital-intensive models, particularly software-focused solutions. These solutions typically offer quicker scalability and a faster return on investment, which appeals to venture capitalists. Notably, over 80% of climate tech startups now integrate AI into their offerings , a trend that aligns with broader business goals to reduce costs and boost efficiency, especially in data-heavy industries.

- Specialized Funds and Patient Capital: The emergence of specialized climate tech funds, such as Breakthrough Energy Ventures, Lowercarbon Capital, and Pale Blue Dot, plays a vital role. These funds embody the concept of “patient capital,” where investors are prepared to commit more capital over longer time horizons and accept higher risks, recognizing that fundamental changes to global energy and industrial structures will not adhere to traditional 3-5 year VC cycles. These specialized vehicles are better equipped to navigate the longer development cycles inherent in many climate technologies.

- Strong Product-Market Fit Requirement for Series A: For Series A funding, startups must demonstrate a robust product-market fit, proving that their product meets a genuine market need and that demand exists. Investors at this stage are not merely seeking great ideas but companies with a strong strategy for translating those ideas into successful, revenue-generating businesses. This focus on commercial viability from the outset, with median pre-money valuations for Series A companies reaching up to $50 million, helps ensure that early investments are directed towards ventures with a clear path to generating returns.

IV. The Later-Stage Funding Gap: Challenges and the “Missing Middle”

While early-stage climate tech continues to attract investment, a significant challenge persists in later-stage funding, often referred to as the “missing middle.” This critical gap primarily affects growth-stage companies seeking Series B, Series C, and Series D+ funding, as they struggle to secure the necessary follow-on capital after proving initial traction. This period is particularly precarious, with a large cohort of climate tech companies reportedly approaching a “Series B cliff,” where access to capital becomes significantly more difficult.

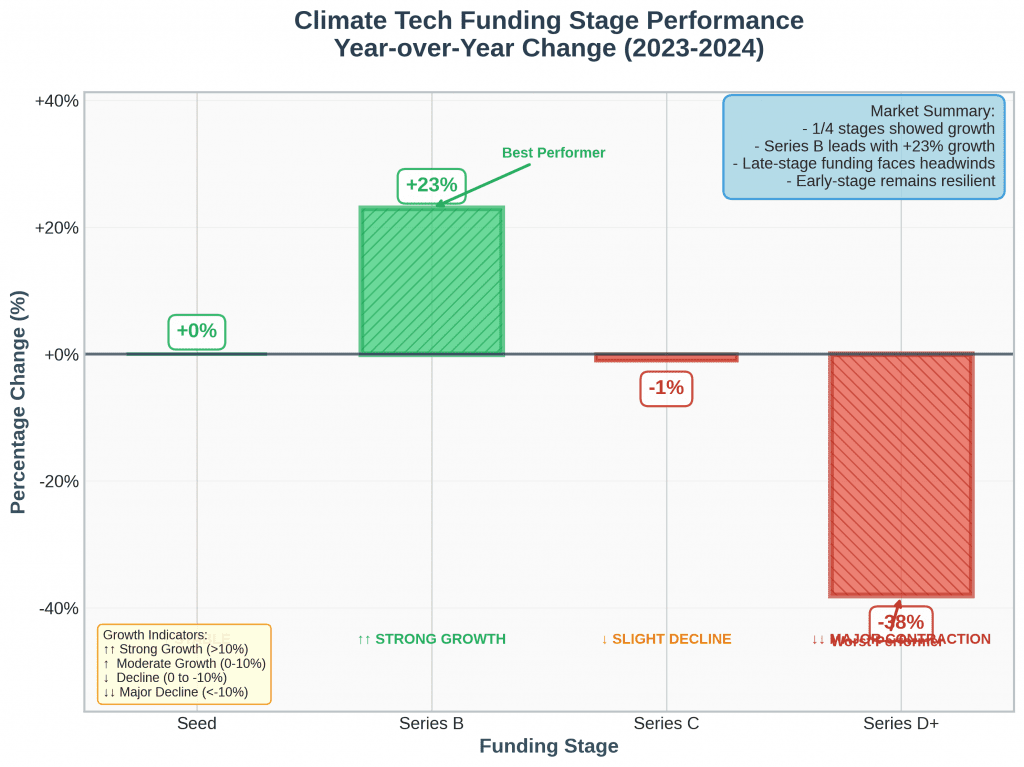

Analyzing the data for later rounds reveals a mixed picture. Series B funding saw a notable 23% increase in 2024, with median rounds reaching a decade high of $30 million. However, this increase was largely the result of a few unusually large deals, such as $1.1 billion for IM Motors, $331 million for Electra, and $308 million for EnerVenue , masking a broader underlying challenge. Investment in Series D and beyond fell by a substantial 38% in 2024, while Series C funding remained essentially flat, experiencing only a 1% decrease. Despite these declines in value, deal counts for both Series C and D+ were up by approximately 20% in 2024 , further suggesting that capital is being concentrated into fewer, larger deals, even as overall investment volume in these stages contracts. Median Series C+ rounds reached a decade high of $60 million in 2024.

The tightening of growth-stage funding is attributable to several interconnected factors:

- Capital Intensity & Long Development Cycles: Climate technology, particularly hardware-based solutions, inherently demands significantly more capital and longer timelines to reach industrial maturity—often 10 to 15 years—compared to software development, which typically aligns with traditional VC horizons of 3-5 years. Developing new materials, chemical processes, or constructing factories can require hundreds of millions of dollars even before commercialization. This fundamental misalignment creates persistent funding gaps, especially during critical scaling phases. This challenge is often referred to as the “industrialization valley of death,” distinct from the earlier “valley of death” for nascent ideas. It represents the immense hurdle of transitioning from a proven pilot or prototype to full-scale production, which can necessitate investments of billions of dollars. This implies that traditional venture capital models are inherently ill-suited for this phase, making new financing mechanisms not just complementary but essential for climate tech to successfully cross this chasm.

- Macroeconomic Headwinds: High interest rates and pervasive economic uncertainties have instilled a greater sense of caution among investors. The previous low-interest rate environment of the Climate Tech 2.0 boom allowed many capital-intensive models to sustain operations despite weak underlying economics. However, the sharp rise in interest rates since 2022 has rendered many of these business models untenable without access to cheap financing. This creates a “cost of capital crunch” that disproportionately impacts later-stage climate tech companies, which require massive infusions of capital for industrialization. Higher interest rates make debt financing more expensive and reduce the attractiveness of equity investments by increasing the discount rate applied to future, long-term returns. This suggests that the scaling of climate tech is highly sensitive to monetary policy, and policy levers like preferential lending rates or government-backed guarantees for climate projects could be crucial to mitigate this effect.

- Shifting Investor Priorities: Investors are increasingly moving away from speculative “hype” towards a stronger focus on company fundamentals, prioritizing sustainable growth, profitability (EBITDA), and operational efficiency. They are more discerning, favoring businesses with proven economics over those relying on speculative growth, and demanding a clear path to profitability earlier in a company’s lifecycle. This constitutes a “profitability imperative,” meaning that climate tech companies must integrate strong unit economics and demonstrate clear paths to profitability, even if their primary mission is environmental impact. The market now views the “use of marketing terminology such as ‘climate tech’ or ‘energy transition’ as irrelevant” if the financial returns are not evident. This necessitates a strategic pivot for climate tech startups, requiring them to integrate financial viability and operational efficiency into their core product development and business model from the outset, rather than solely focusing on technological breakthroughs or environmental impact.

- Competition for Capital: The AI Boom: The explosive growth of generative artificial intelligence (AI) has captured significant investor attention and capital, inevitably diverting funds away from other sectors, including climate tech startups. Venture capital investments in startups surged by nearly 30% in 2024, largely propelled by the booming AI industry. This dynamic suggests a “zero-sum game” in venture capital allocation, where capital flowing into AI is capital not available for other sectors. This competition is not limited to general VC funds; corporate venture capital (CVCs) are also increasingly focusing on AI. This implies that climate tech is not just competing on its own merits but against a highly attractive, rapidly scaling, and potentially less capital-intensive alternative. To attract investment, climate tech companies may need to either demonstrate clear, rapid paths to profitability that rival AI’s, or strategically integrate AI into their solutions to become part of the “hot spot” of AI-related climate tech investment.

- Policy and Regulatory Uncertainty: Climate tech is uniquely susceptible to shifts in political and regulatory environments. Potential policy changes, such as a change in U.S. administration priorities (e.g., from a climate-conscious stance to one favoring fossil fuel production), create significant uncertainty that deters investment. Delays in the rollout of funding from initiatives like the Inflation Reduction Act (IRA) have also created headwinds. Furthermore, navigating complex and varying regulations across different regions presents a daunting and time-consuming challenge for startups. This creates a “policy risk premium” that investors demand for climate projects, making them less attractive than sectors less exposed to political volatility. The weakening of the IRA and challenges to the European Green Deal directly impact investor confidence and the perceived stability of future markets for climate solutions. For climate tech to thrive, there needs to be greater global consensus and long-term policy stability that transcends political cycles, thereby reducing the perceived policy risk for investors.

- Limited Exit Opportunities: The “exit window”—the crucial pathway for startups to go public or be acquired—is currently “slamming shut”. Tech IPOs, a traditional liquidity event for venture-backed companies, fell by 60% between 2020 and 2024, with billion-dollar tech exits plummeting from 21 in 2021 to just 7 in 2023. Public markets have seen a much larger decline in activity, compelling many startups to raise growth-stage equity to avoid undervaluation in public offerings. While climate tech exits more than doubled in 2024 compared to 2023 , acquisitions constituted the vast majority (92%) of these exits, and most were undisclosed, signaling smaller outcomes. Over 70% of exiting companies in 2024 had not raised beyond Series A financing. The scarcity of lucrative exits, particularly large IPOs , creates a “liquidity trap” for later-stage investors. Growth equity and Series B/C investors require clear pathways to realize returns within their fund’s lifecycle. If exits are predominantly smaller, undisclosed acquisitions of early-stage companies, it suggests that larger, more mature climate tech companies are struggling to find attractive liquidity events, directly impacting the willingness of later-stage funds to commit capital due to fears of illiquid investments. This underscores the need for a more robust mergers and acquisitions (M&A) market for mature climate tech companies, potentially driven by large industrial players or private equity, and a recovery in the IPO market for high-growth climate innovators.

- High-Profile Failures: The bankruptcy of Northvolt in November 2024, an electric vehicle battery developer that had raised a cumulative $9 billion, serves as a painful modern-day echo of the Solyndra episode. Northvolt succumbed to high industrial costs, execution delays, and exacerbated price competition. Such high-profile failures have a “reputational contagion” effect that extends beyond the individual company. They validate existing investor fears about the sector’s capital intensity, long timelines, and market risks, making it more challenging for all climate tech companies, particularly those in hardware or heavy industry, to secure later-stage funding. This creates a psychological barrier for investors who were burned in Cleantech 1.0 or are wary of similar outcomes. To counteract this negative perception and rebuild broader investor confidence, the sector needs to proactively highlight successful scale-ups and exits, even if smaller in scale.

Table 1: Key Challenges in Later-Stage Climate Tech Funding

| Challenge Category | Description | Impact on Later-Stage Funding |

| Capital Intensity & Long Development Cycles | Climate tech (especially hardware) requires significant capital and 10-15 years to industrial maturity, clashing with 3-5 year VC horizons. | Creates “industrialization valley of death”; traditional VC models ill-suited for billions needed for full-scale deployment. |

| Macroeconomic Headwinds | High interest rates and economic uncertainties make investors cautious; rising cost of capital impacts debt and equity attractiveness. | Leads to a “cost of capital crunch” disproportionately affecting capital-intensive later-stage companies. |

| Shifting Investor Priorities | Investors demand strong fundamentals, sustainable growth, and clear paths to profitability (EBITDA), moving away from “purpose-driven spending.” | Necessitates a “profitability imperative” for climate tech, requiring early demonstration of financial viability alongside impact. |

| Competition for Capital (AI Boom) | Generative AI attracts significant VC and CVC capital, diverting funds from climate tech. | Creates a “zero-sum game” where climate tech competes with a less capital-intensive, high-growth alternative. |

| Policy & Regulatory Uncertainty | Potential policy shifts (e.g., US administration changes, IRA delays) and complex, varying regulations deter investment. | Imposes a “policy risk premium,” making climate tech less attractive without long-term, stable policy frameworks. |

| Limited Exit Opportunities | Falling tech IPOs and a prevalence of smaller, undisclosed acquisitions create a “liquidity trap” for later-stage investors. | Hinders growth equity and Series B/C investors from realizing returns, making them wary of illiquid investments. |

| High-Profile Failures | Bankruptcies like Northvolt (echoing Solyndra) reinforce investor fears about capital intensity, execution risks, and market competition. | Creates “reputational contagion,” validating existing risks and making it harder for all climate tech to secure funding. |

Export to Sheets

V. Strategic Pathways to Bridge the Funding Gap

Addressing the climate tech investment paradox and bridging the “missing middle” requires a multi-faceted approach, leveraging innovative financing models, strengthening corporate engagement, maximizing government support, and optimizing for commercial viability.

Innovative Financing Models

The inherent challenges of climate tech, such as its capital intensity, long development cycles, and exposure to policy risks, are not fully solvable by traditional venture capital alone. The market has begun to recognize this, leading to the emergence and necessity of “tailored capital” structures that align with the unique risk-return profiles and timelines of climate solutions. This represents a fundamental shift from a “one-size-fits-all” VC model.

- Patient Capital: This involves funds willing to commit more capital over longer time horizons, accepting higher risks. Examples include Breakthrough Energy Coalition and Breakthrough Energy Ventures, which are designed to support climate projects that require more time and capital than typical VC investments.

- Growth Equity: This form of investment is crucial for scaling proven technologies and business models, effectively bridging the gap between early-stage VC and large-scale commercial deployment. Growth equity firms provide not just capital but also essential operational and scaling expertise, helping companies transition from a few initial customers to widespread adoption. This is particularly valuable for climate-focused companies that need to optimize go-to-market strategies and pricing models, often by leveraging sustainability and carbon-related data as a commercial lever.

- Blended Finance: This innovative approach uses public or philanthropic capital (such as low-interest loans, guarantees, and first-loss capital) to de-risk projects and attract private investment into initiatives with significant social or environmental benefits. Breakthrough Energy Catalyst, for instance, exemplifies this model by blending public, corporate, and philanthropic capital to fund large-scale demonstrations in critical areas like green hydrogen and direct air capture, thereby making scale-up less risky for follow-on investors. This mechanism is vital for addressing the “funding dead zone” in the missing middle.

Strengthening Corporate Engagement

Corporate engagement in climate tech is evolving beyond mere investment; it is moving towards an “corporate integration” model. Large corporations are increasingly investing directly in climate startups not just for financial returns, but to meet their own net-zero targets and integrate innovative solutions into their existing operations or supply chains.

- Strategic Investors & “Bridge Lenders”: Corporations can act as strategic investors and “bridge lenders” by investing in early deployments of climate technologies, thereby reducing risk for future private investment. Microsoft’s partnership with Lithos Carbon, funding CO2 removal over three years, is a prime example of corporate leadership actively bridging the “funding dead zone” for enhanced rock weathering startups.

- Network Resources: Beyond capital, corporations offer invaluable resources, including internal R&D capabilities, access to global markets and supply chains, manufacturing facilities, and extensive industry experience across the energy system. This provides startups with a large-scale customer base, a clear pathway to commercialization, and critical validation that de-risks future funding rounds. Climate tech startups should actively pursue strategic partnerships with large corporations, viewing them not just as investors but as potential customers, partners, and channels to scale.

Leveraging Government Support

Government support, through policy incentives and direct funding, acts as a “de-risking public hand” for climate tech. By providing grants, tax credits, and loan guarantees, governments absorb some of the early-stage and industrialization risks that private capital often shies away from. This makes climate projects more attractive for private investors by improving their risk-adjusted returns.

- Significant Policy Frameworks: Comprehensive policy frameworks, such as the Inflation Reduction Act (IRA) in the US, which allocates $370 billion in clean energy incentives, and the European Green Deal, provide substantial incentives and create a favorable environment for climate tech growth.

- Targeted Programs: Government agencies like the U.S. Department of Energy (DOE) offer various programs designed to support clean energy innovation and commercialization, particularly for later-stage deployment and industrial decarbonization. Examples include the Technology Commercialization Fund (TCF), the MAKE IT Prize, the Lab MATCH Prize, and the SOLVE IT Prize. The Environmental Protection Agency (EPA) also offers numerous partnership programs focused on reducing greenhouse gas emissions and building climate resilience.

- International Funds: Organizations such as the Green Climate Fund (GCF) play a crucial role in accelerating climate action in developing countries by providing flexible financing solutions and project funding for initiatives ranging from climate-resilient agriculture to early warning systems. The stability and long-term commitment of government policies are paramount for the climate tech sector, as they reduce the perceived policy risk for investors.

Optimizing for Commercial Viability

The shift in investor priorities towards profitability means that climate tech innovation can no longer be purely technology-driven. It must adopt a “market-first innovation” paradigm, where the development of solutions is deeply intertwined with a clear understanding of market demand, competitive landscape, and pathways to profitability. This is a departure from the “build it and they will come” mentality that characterized some Cleantech 1.0 ventures.

- Focus on Fundamentals: Startups must demonstrate strong fundamentals, clear pathways to profitability, and capital efficiency from their earliest stages. This includes prioritizing strong unit economics and scalable solutions with demonstrated real-world adoption. In a challenging market, companies must focus on doing “more with less”.

- Leaner Growth Strategies: Startups should adopt leaner growth strategies, including cautious hiring and prioritizing roles that directly drive profitability and efficiency.

- Diverse Funding Sources: Relying solely on traditional VC is insufficient. Startups should actively seek a mix of funding, including private equity, project financing, and government grants, and cultivate an understanding of the “patient capital” mindset.

The AI-Climate Tech Nexus

The data clearly indicates that AI is currently siphoning capital from other sectors. However, AI within climate tech is thriving, creating a “synergistic imperative.” Climate tech companies that can effectively integrate AI into their solutions not only enhance their efficiency and impact but also tap into a currently favored investment stream. This is not just about using AI as a tool but about AI becoming a core component of the climate tech value proposition, making it more attractive to investors seeking both climate impact and high-tech returns.

- Growth Hotspot: AI-centered climate solutions represent a significant growth hotspot for investment, attracting approximately $6 billion in venture capital funding in the first three quarters of 2024 alone, surpassing the total for all of 2023. Key segments attracting this investment include autonomous vehicles, industrial applications in agriculture, smart homes, and smart energy.

- Efficiency and Innovation Driver: AI offers immense potential to optimize various climate solutions, from managing demand for EV charging stations and predicting weather patterns for wind turbine performance to analyzing vast volumes of sustainability data and optimizing supply chains. Over 80% of climate tech startups now integrate AI into their operations.

- Addressing Energy Demands: The rapid growth of the AI industry and its substantial energy demands are paradoxically driving investments in cleaner data centers, energy storage, and grid technologies. This creates a direct link between the AI boom and the need for climate solutions.

VI. Outlook and Recommendations

Future Projections

The climate tech investment market is currently stabilizing into a “new normal,” characterized by a slower, more linear growth trajectory compared to the exponential surge seen in 2020-2022. While economic uncertainties and high interest rates continue to pose challenges, the fundamental imperative to address climate change remains, suggesting that investment will eventually normalize and return to a more robust pace. The market will continue to prioritize companies demonstrating strong profitability, scalability, and cost discipline. Acquisitions are projected to remain the primary exit route for climate tech startups, with smaller, often undisclosed deals dominating the landscape.

Actionable Recommendations

To navigate the current investment paradox and accelerate the deployment of critical climate solutions, strategic adjustments are required across the ecosystem:

For Climate Tech Startups:

- Prioritize Profitability & Capital Efficiency: Develop business models with strong unit economics and clear, demonstrable paths to profitability from the earliest stages. Focus on lean growth strategies and operational efficiency to achieve “more with less”.

- Strategic Fundraising: Diversify funding sources beyond traditional venture capital. Actively explore growth equity, blended finance models, and government grants, understanding the nuances of “patient capital” and its longer investment horizons.

- Cultivate Corporate Partnerships: Proactively seek strategic partnerships with large corporations. These relationships can provide not only investment but also crucial market access, industrial integration, and validation that de-risks future funding rounds.

- Leverage AI for Competitive Advantage: Explore and articulate how artificial intelligence can enhance solutions, improve efficiency, and boost scalability. Pivoting towards AI-powered models, where feasible, can attract a broader and more enthusiastic investor base.

- Navigate Regulatory Landscapes: Engage actively with policymakers and stay informed on evolving policy changes. This proactive approach allows startups to leverage available incentives and mitigate regulatory risks, which are particularly pronounced in climate tech.

For Investors:

- Embrace Diversified Investment Horizons: Acknowledge the longer development cycles and capital intensity of many climate technologies. Consider patient capital and growth equity models as essential components of a climate tech portfolio, moving beyond traditional quick-exit VC mandates.

- Deepen Sector Expertise: Develop specialized knowledge in climate tech verticals, particularly those requiring heavy infrastructure. This expertise is crucial for accurately assessing the unique risks and opportunities associated with these complex solutions.

- Seek Blended Finance Opportunities: Actively collaborate with public and philanthropic entities to de-risk later-stage investments. Blended finance mechanisms can mobilize private capital into projects that might otherwise be too risky or long-term for conventional funding.

- Focus on Proven Fundamentals: Prioritize investments in companies that demonstrate strong unit economics, operational efficiency, and clear, credible paths to commercialization and profitability, rather than solely relying on environmental impact claims.

- Identify AI-Climate Tech Synergies: Actively seek out and invest in climate tech solutions that are enhanced or powered by AI. This intersection represents a high-growth area that can deliver both significant climate impact and attractive returns.

For Policymakers:

- Ensure Policy Stability & Predictability: Implement long-term, stable policy frameworks, including clear carbon pricing mechanisms, mandates, and green procurement policies, that transcend political cycles. This predictability is vital for reducing investment uncertainty and encouraging sustained private capital flow.

- Expand De-Risking Mechanisms: Increase and streamline government grants, loans, and guarantees for later-stage climate tech, especially for capital-intensive “first-of-a-kind” (FOAK) projects. These mechanisms are crucial for bridging the “industrialization valley of death” that private capital often avoids.

- Foster Industrial Partnerships: Create incentives and supportive frameworks for large corporations to invest in and acquire climate tech startups. This facilitates industrial integration, accelerates market adoption, and provides crucial exit opportunities for investors.

- Support Global Collaboration: Work towards simplified global efforts and the establishment of common taxonomies for climate finance, particularly for adaptation solutions, to enhance cross-border investment and collective action.

Leave a Reply

You must be logged in to post a comment.